VAT Software

by handling VAT registration, setting VAT rates, creating and filing VAT returns, and much more

Benefits of using Codejig VAT software

Submit your VAT return promptly

Using our VAT accounting software, you will be able to create, manage, track, and submit your VAT returns with ease. Worrying about your VAT responsibilities will be a thing of the past.

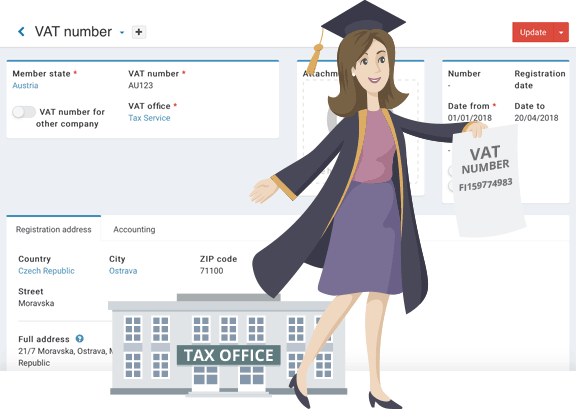

Automate all your VAT processes

There are many responsibilities that come with being registered as a VAT payer. This also means that you become eligible for VAT returns. Our VAT software will automate all those processes, making it easy for you to understand. Using our online VAT software, you will also have the possibility to register as a VAT-payer in multiple countries. You can also notify the system when your VAT registration is canceled so that all the transactions and operations regarding VAT are turned off.

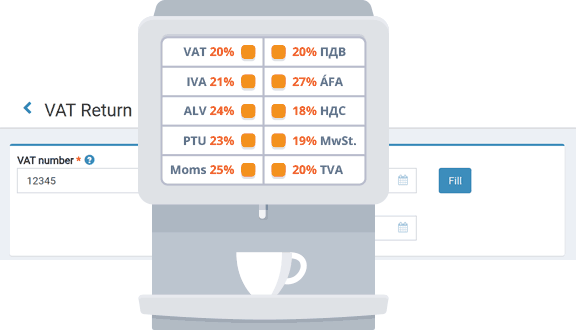

Create your VAT reports with ease

Creating VAT reports becomes easy and smooth using our VAT accounting software. You will be able to automatically generate autocomplete VAT returns within seconds. All you need to do is to choose the period for which you want to calculate the VAT return. With this, you will get an error-free report.

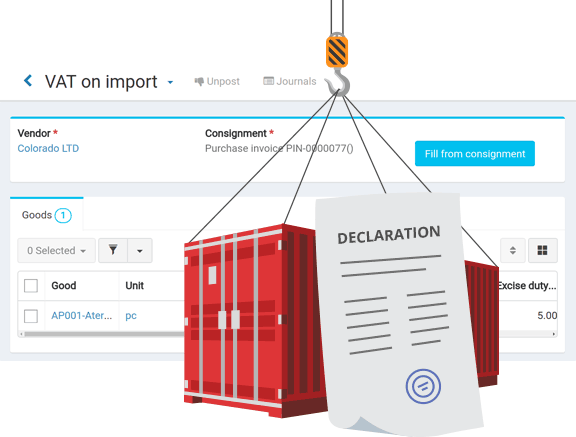

Easily add goods to your declaration

With the Codejig VAT software, you do not have to go through all the headaches of creating customs import declaration. The software will automatically use all your products and their details from documents such as invoices or receipts to create the declaration. This way, no goods or services will be left out since you are not adding them manually.

Access your VAT reports from any location

The Codejig cloud-based VAT accounting software stores all your information on a cloud, making it available from any location with an internet connection.

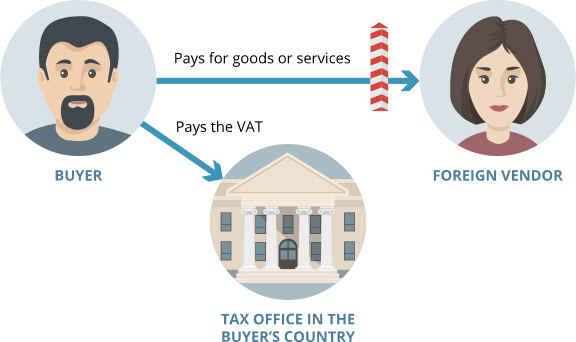

Benefits of VAT registration

Even though VAT registration is compulsory after a certain threshold which may differ in different countries, as a startup, you can still register voluntarily. Here are some benefits of doing that:

Prevent financial penalties

Many businesses do not notice when their turnover figure has passed the threshold for registration. With this, they start to incur penalties without even knowing. To avoid this trouble, it is better to register earlier.

Build up business profile

As a startup, competing against big enterprises can be challenging. One of the ways to get past this challenge is by VAT registration. Once you register, a VAT number is assigned to you that can be placed on all your documents such as emails, invoices, letters, etc. This gives the impression that your company is established, big, and legit. Also, more people will be willing to do business with your enterprise once it is registered.

Recover the VAT you paid previously

You become eligible to recover the VAT paid previously after a period of 4 years when you do the VAT registration. Even if your business has not attained the threshold by this time, you are still able to recover the VAT if you have the proper documents to prove it. This can significantly boost the income of your business.

Registering for VAT without a proper software to calculate and manage your transactions is almost as challenging as not registering at all. The Codejig VAT software will take care of all your VAT needs.